- Prelude

- Editorial

- Interpretation of Antiquities and Art Treasure Act

- Jawahar Sircar

- Dr. Gautam Sengupta: Director General ASI

- Preserve our Heritage

- In Camera: An Unobtrusive Gaze of the Filmmaker's Journey

- A look into the Patna Museum

- Museums of Madhya Pradesh: An Overview

- A Collection of Museums and a Museum for Collectors (Museum & Galleries at Chitrakala Parishath, Bangalore)

- Discovery: Andhra Paintings of the Ramayana

- An Art work can be Reproduced not the Antique

- Hazarduari Palace Museum: One of the 7 wonders of India

- The Silken Embroidery of Antique Collection

- Khuddur Jatra: a transformation from literature to art and back to literature

- India Art Festival A Preview

- Warping the Modernist Space: Stylistics of Postmodern Architecture

- Vintage Radio

- Sekhar Roy

- Who's afraid of AATA and what is it afraid about?

- China's rise and India's place

- What Happened and What's Forthcoming

- Art Events Kolkata: April – May 2011

- The more the merrier

- Mumbai Art Sighting

- North East Opsis

- Art Bengaluru

- Musings from Chennai

- Previews

- In the News

ART news & views

China's rise and India's place

Volume: 3 Issue No: 17 Month: 6 Year: 2011

Market Insight

by AAMRA

It is a forgone conclusion that China is the biggest potential market for art at this point of time. It is far ahead of New York and London. However, in terms of return, especially when the duopoly is considered, the leading light of BRIC (acronym for Brazil, Russia, India and China) is still trailing behind New York.

Artprice's Art Market Trends 2010 is of the opinion that, “In the global top-10 ranking of auction companies by revenue (ranked by total 2010 revenue), Christie's and Sotheby's continue to hold the top two positions with their perpetual competitive rivalry and they still generate half of their revenue in New York compared with roughly 10% from their Hong Kong branches. Their revenue totals of $2.47 and $2.41 billion respectively are still $1.8 billion higher than the $677.9m generated by China's Poly International, the planet's third auction house by revenue. Behind Poly there are two more Chinese firms, China Guardian ($498m) and Beijing Hanhai Art Auction ($256.1m).

'Phillips de Pury & Company is in sixth place with $225.8m followed by more Chinese companies: Beijing Council ($193.8m), Beijing Jiuge ($152.3m), Xiling Yinshe ($138.1m) and Beijing Highest Auctions ($103.7m). In sum, there are seven

Chinese companies amongst the world's top-10 auctioneers, plus the habitual

Christie's / Sotheby's / Phillips de Pury & Company trio. The first other Western auction house in the ranking is in twelfth place (Bonhams with $80.7m) and the first French company is in eighteenth place (Artcurial with $53.29m).”

That perhaps also explains top 500 artist's performance worldwide that the same volume ends with. The lists are peppered with Asian names, and among them Chinese artists are hugely present.

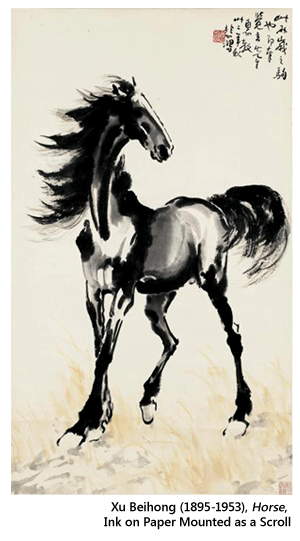

Within the first 10 itself, Daqian Zhang, who was placed 11th at the end of 2009 is fourth, with an auction turnover of $304,303,005 in 2010, as compared to $40,052,284 in 2009. He comes just after Picasso, who tops the chart at an auction turnover of $341,493,772 in 2010, followed by Baishi Qi at $339,231,302 and of course Andy Warhol whose turnover for the year has been $313,535,564. Actually, Alberto Giacometti, whose Man Walking I had raised quite a storm last year as a single piece of art sold at the highest price before Picasso's Nude, Green Leaves and Bust overtook him, falls well short of Zhang at $213,618,702. Moreover Giacometti is closely followed by yet another Asian name, Beihong Xu, who has come up 13 notches from 2009 from 19th to sixth with an auction turnover of $176,249,208.

This has mainly been due to the zealous selling by Chinese corporations, who may yet have to over the global duopoly, but are breathing close on their necks and have already left the London giant Bonhams far behind.

Artprice has this to say about Zhang and Xu.

“(Zhang) is extremely sought after in Hong Kong (57% of his revenue) and in China (40% of revenue) and his market is extremely dense. His 2010 auction revenue of $304.3m (vs. Warhol's $313.5m and Picasso's $361.5m) was generated by more than 800 works. At Christie's Hong Kong Fine Chinese and modern paintings sale on 30 November (2010), Zhang Daqian signed 2 million-plus results. The overall result from that sale was indeed spectacular, generating a total of $60.58m and an exceptionally low buy-in rate (4.6% of the 239 lots offered). About Xu, Artprice opines, “Xu was born in Yixing region of the Jiangsu in 1895 and died in 1953. He studied oil painting and drawing at the École Nationale Supérieure des Beaux-Arts in France. Despite this experience, French auction houses never offer his works. The heart of his market is in China (55%) and in Hong Kong (43%) where 98% of his auction revenue is generated. Whenever possible, the Christie's and Sotheby's Hong Kong branches include his work in their Asian art sales.

His most expensive works are realist oil paintings from the 1920s and 1930s. When of museum quality, these works can fetch between $5m and $20m. His ink rolls, mixing respect for Chinese tradition and thirst for modernity, can also fetch similar prices. On 10th December 2010, a 3-metre roll entitled Landscape and figure set a new record for Xu Beihong with a winning bid of ¥153m ($23m) at Beijing Hanhai Art Auction. Chinese collectors have shown an extraordinary appetite for his works, sending his price index into orbit.”

Artprice doesn't mince words to accept that the real pulse of the art market, especially after the recessionary years, however are to be felt in Asia. “The pulse of the market can now be measured in Beijing, Hong Kong, Shanghai and Hangzhou the new driving hubs of the global art market where Sotheby's (2% of global revenue generated in Hong Kong), Christie's (2.5% in Hong Kong), Poly International (7.4% in Beijing), China Guardian (5.32% in Beijing), Beijing Council (2.07% in Beijing) and Beijing Hanhai Art Auction (2.74% in Beijing) are all operating at full steam.

'The Beijing marketplace is now the second (largest) marketplace in the world behind New York in terms of revenue since the Big Apple generated auction revenue of $2.7 billion in 2010, i.e. $400m more than Beijing. These two art capitals are however already neck and neck in terms of average prices: approximately $129,000. London is in third place with total revenue of $1.8 billion ahead of Hong Kong and then Paris, Shanghai and Hangzhou.”

Which leaves us with the question where does the other Asian giant, India, stand in the scheme of things on the global art map?

According to Artprice's artists' auction turnover index, India would be placed at a far off 106th place, occupied by Sayed Haider Raza (up from 219th) with an auction turnover of $13,008, 260 in 2010, as compared to $3,194,036. In fact, considering that Indian artists depend exclusively on global auction houses to make any kind of impact on the world scene, which is extremely good to say the least, with an incremental of $10,000,000 in one year, that too just after recession. In fact 2010 has been a remarkably good year for Raza, with 84 lots sold as compared to 45, almost half the number in 2009.

The others in the fray are M F Hussain, Anish Kapoor and Subodh Gupta, in that order.

Hussain has gained in position just like Raza, from 176 in 2009 to 164 in 2010, more than doubling his turnover from $3,940,640 in 2009 to $8,404,687. Anish Kapoor has however depleted his position by quite a few notches, turning up at 182 from 102 in 2009, although his turnover is still slightly better than 2009, up from $7,633,579 to $7,703,756. The last in the top 500 list is Subodh Gupta, at 394. However, compared to where he was in 2009, at 975th, that's a huge achievement his auction turnover up from $627,486 in 2009 to $2,972,907 in 2010.

However, in overall ranking India has suffered. Kapoor who was at very close to the top 100 mark in 2009, has lost out, while Raza has been able to make just up to 106th.