- Publisher's Note

- Editorial

- In Conversation with Kanishka Raja

- Definitional Lack in an Inclusive World: Cutting Edge as Responsible Art

- Democratization Through Cutting Edge Art

- Mumbai for Cutting Edge

- Moments in Time (And a Little While After)

- In Transition

- Tip of Our Times

- Srishti School of Art, Design and Technology – A Cradle for Creative Excellence

- Cutting the Edges of Architecture

- Overview Cutting Edge

- The Matter Within: New Contemporary Art of India Featuring Photography, Sculpture and Video

- Generation in Transition: New Art from India

- Indian Master Painters at India Art Festival

- Life, Luxury & the Avant-Garde

- Mother India: The Goddess in Indian Painting

- The Last Harvest: Paintings of Rabindranath Tagore

- Asia Society Museum Presents Exhibition of Rabindranath Tagore's Paintings and Drawings

- Stieglitz and his Artists: Matisse to O'Keeffee

- Beauty of Unguarded Moments

- Across Times, Across Borders: A Report on the Chinese Art Exhibition

- A Summer in Paris

- Random Strokes

- The Emperor’s New Clothes and What It Really Means

- Understanding Versus Adulation

- What Happened and What’s Forthcoming

- Occupy Wall Street, The New Economic Depression And Populist Art

- Unconventional with Witty Undertones

- Narratives of Common Life and Allegorical Tales In Traditional and Modern Forms the Best of Kalighat 'Pats'

- Colours of the Desert

- Unbound

- I Am Here, An Exhibition of Video Self Portraits at Jaaga

- Staging Selves: Power, Performativity & Portraiture

- Venice Biennale Outreach Programme A Circle of Making I and II

- Cartography of Narratives, Contemplations on Time

- Joseph Kosuth: The Mind's Image of Itself #3' A Play of Architecture and the Mind

- Maharaja: Reminiscing the Glorious Past

- Art from Thirteen Asian Nations

- Tibetan Arms and Armor at Metrpolitan Museum of Art

- The Art of Poster Advertisement

- Unusual Angles and Facets of Museum Buildings

- Elegant Fantasies

- Art Collection and Initiatives

- Art Events Kolkata

- Mumbai Art Sighting

- Art Bengaluru

- Musings from Chennai

- Preview

- In the News

ART news & views

The Emperor’s New Clothes and What It Really Means

Volume: 4 Issue No: 22 Month: 11 Year: 2011

Market Insight

While we are on the subject of cutting edge art, let us look at what Britain's most celebrated contemporary artist is doing to ensure his market value. In September, The Telegraph, UK reported, “There is an old joke that the clue to contemporary art is in the name: it is a con, and it is temporary. Even those inured to the industry's excesses, however, might have been surprised by a report … about Damien Hirst. Not apparently content with his £215 million fortune, the original Young British Artist has allegedly taken to “bullying” auction houses into refusing to sell prints individually, insisting that they should be sold only as a complete package.

While we are on the subject of cutting edge art, let us look at what Britain's most celebrated contemporary artist is doing to ensure his market value. In September, The Telegraph, UK reported, “There is an old joke that the clue to contemporary art is in the name: it is a con, and it is temporary. Even those inured to the industry's excesses, however, might have been surprised by a report … about Damien Hirst. Not apparently content with his £215 million fortune, the original Young British Artist has allegedly taken to “bullying” auction houses into refusing to sell prints individually, insisting that they should be sold only as a complete package.

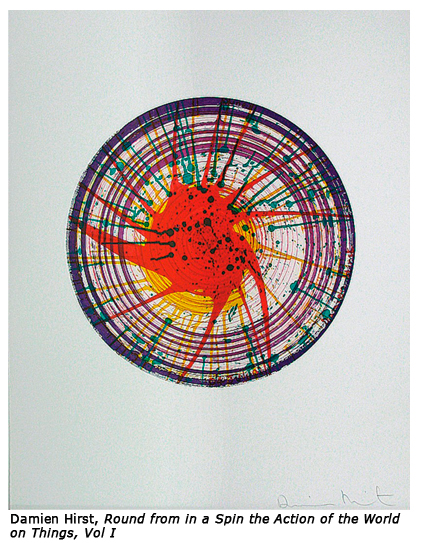

The work in question was In a Spin, the Action of the World on Things, a 4ft by 3ft box covered in one of Hirst's iconic spin paintings, which are created by a machine pouring paint on to a canvas. Inside each box (Hirst made 68 of them) are 23 signed prints of spin images.

John Brandler, an art dealer in Essex, tried last month to sell two of the box-top paintings, valued around £75,000, via Phillips de Pury, the auctioneers. They refused, despite handling two similar sales recently, saying that Hirst was now opposed to anyone attempting to sell In a Spin without the accompanying prints. Given that many of these prints are already owned individually, bought for between £2,000 and £4,000, there are fears that people might have unwittingly bought an unrealisable investment.

Nonsense, said a spokeswoman for Hirst, blaming a “miscommunication internally” at the auctioneers. Hirst was interested only in ensuring that buyers knew the prints were part of one artwork and correctly attributed. He was not interested in preventing people selling what they wanted.”

In this context, let us look at how the market really looks at Hirst. According to the Fair Value Report of Hirst published in 2010 by ArtTactic, “Since 2008, Damien Hirst's average auction prices for large paintings are down by 48%. A good example of the price correction can be seen by following the butterfly painting 'I miss you' (1997/98). The work was initially sold at the Pharmacy auction in 2004 for £230,000. The painting came back to auction on two further occasions; February 2008 at an estimate of £700,000 900,000, where it failed to sell, and in October 2008 at an estimate at £500,000 - £700,000, where it also failed to find a buyer. The work finally found a buyer in October 2009 at £280,000, 71% lower than the average estimate in February 2008.”

The reality thus is absolutely different from what Hirst poses himself to be. The 46-year-old Hirst has never shied away from squeezing every last drop of cash out of his work: on one occasion he went to the extent of forcing a 16-year-old student who had used an image of his diamond-studded skull for an internet collage to hand over £200, notes The Telegraph. And Hirst has actually, since the now-infamous Pharmacy sale, been able to build up a kind of patronisation, that has gone to any lengths to make him look like a 'much-sought-after' artist. As the ArtTactic report clearly says, “Since the Pharmacy sale in 2004, the Hirst market managed to build up an insatiable appetite for ownership of Hirst Plc- a brand that was seen as lucrative investment, and with art that was edgy and cool - a must-have for any collector starting out. "Lately his brand has become synonymous with excess, greed, and a market that started to believe its own prophecy. Like many of the bankers, Hirst turned from genius to villain - a reputation that the market still has to come to terms with.

“There is no doubt that the Beautiful Inside My Head Forever sale left a bitter taste for many buyers who bought at the top of the market. And although the financial loss might have hurt some, being seen as the Greatest Fool has been harder to swallow.”

How Hirst worked his market is explained by The Telegraph: “Having shot to prominence in 1992 when Charles Saatchi displayed his shark in formaldehyde (dismissed by one newspaper as “£50,000 for fish without chips”), Hirst cemented his place as Britain's richest artist in 2008 when a Sotheby's auction of his work raised £111 million in two days. It was reported that some of his closest business associates, who had an interest in maintaining the high value of his work, accounted for £40 million of the bids and purchases on the first day.”

Now that is where the catch for Hirst or for that matter most 'cutting-edge' artists liedeveloping a so-called 'patron-base', who will cover a period of time direct the trends of the market for the artist. The reasons for them doing this are different the most common one being that one or a few of them already posses a large number of works by the concerned artist, and thus stands to gain if there is an upsurge in buyer-interest in the artist. In this way, all of a sudden, a large number of works by the artist floods the market, and are picked up at high prices by different buyers. When it comes for these secondary buyers to sell, they start getting outright rejected, as had happened in the case of Hirst all through 2008 after the Pharmacy sale.

Frankly speaking, contemporary art is so diverse in its matrix and mode of expression, that the work of each artist is more a matter of perception, since there is no fixed matrix or a given benchmark, against which a particular piece of art can be adjudged. This open-endedness actually is worked upon by the more 'successful' artists, and they try their best to 'bully' the market. Galleries and auction houses often fall prey to popular perception, which is worked upon by simulated bidding by 'business associates', blitzkrieg-ing media coverage and then a sudden flooding in the market of works by the artist.

To come back to Hirst, so what is his exact position vis-à-vis the market now?

The Art Tactic analysis notes, “Average auction prices for Hirst's paintings reached a peak in 2007 when 'Eternity' sold for $8.5 million to New York dealer Philippe Segalot. In 2009 the average price dropped by 35% from 2007's $1,504,557, and 2010 has seen prices levelling out around the $735,000 mark, which brings us back to 2005 levels. The highest price achieved for a Damien Hirst work in auction (in 2010) is Devotion (2003) a large, oval-shaped butterfly painting sold through Christie's London in June 2010 for $929,600.

“As we can see …, Butterfly paintings have been among the highest valued and most sought after works among Hirst's painting series. In terms of comparable performance, the average price for the butterfly paintings has seen a smaller drop than Spot paintings, which is Hirst's other popular and most prolific series. This signals that while the two market segments were on par in 2007, buyers are currently putting a premium on the Butterfly paintings relative to the Spot paintings, largely because of the rarity factor and the fact that the production of Butterfly paintings has stopped.”

Hirst is just an example of how fragile the market for contemporary art can be. Coming back to even Hirst's Indian counterparts, despite the presence of such names as Bharti Kher and Anish Kapoor, the true picture of the overall market scenario is not that encouraging. The Art Tactic Indian Market Survey 2011 specifically states, “The price segment confidence analysis graph for the Indian contemporary market, reveals how uncertain the market sentiment has become with regards to value and prices. After the top end of the market lost all the confidence in May 2009, the October 2009 survey showed that market confidence was creeping back into the top end of the price spectrum, with 17% of the respondents being positive to the high-end of the Indian art market (works valued at $500,000 to $1 million) and 34% of the respondents were positive to the $100,000 to $500,000 price bracket. However, the May 2011 reading showed that much of this confidence had been quashed by the difficulties that the Indian contemporary art has had in establishing any significant price benchmarks in the last 6 months.”

To end, it would be right to quote The Telegraph again “Neither is it the emperor's fault if no one has noticed that he's naked. He's entitled to try to influence the market, just as the market is entitled to ignore him. It's not as if he hasn't warned us.”

To end, it would be right to quote The Telegraph again “Neither is it the emperor's fault if no one has noticed that he's naked. He's entitled to try to influence the market, just as the market is entitled to ignore him. It's not as if he hasn't warned us.”

So there you are. Be warned when it comes to contemporary art anywhere in the world, no matter what the name is. Or else you may just end up looking like somebody you never quite wanted to be.

.jpg)

.jpg)