- Prelude

- Editorial

- Subodh's 'return home'

- A Conversation with TV Santosh

- It's a War Out There

- Raqib Shaw

- Illusions in Red from a very British Indian Sculptor

- Stand Alone: Shibu Natesan

- Reading Atul Dodiya

- Bharti Kher: An Obsession for Bindis

- Bose Krishnamachari

- The Image - Spectacle and the Self

- From Self-depiction to Self-reference: Contemporary Indian Art

- GenNext: The Epitome of New Generation Art

- Kolkata's Contemporary Art A Look in the Mirror

- Innovation Coalesced with Continuing Chinese Qualities

- Kala Bhavana-Charukala Anushad Exchange Program

- Montblanc Fountain Pens

- Dutch Designs: The Queen Anne Style

- Bangalore Dance Beat

- Decade of change

- Distance Between Art & It's Connoisseur

- What Happened and What's Forthcoming

- 3rd India Art Summit

- New Paradigms of the Global Language of Art

- Black Brown & The Blue: Shuvaprasanna

- Art Events Kolkata

- Musings from Chennai

- Art Bengaluru

- Printmaker's Season

- Mumbai Art Sighting

- The Pause of Profound Stillness

- Previews

- In the News

- The Rebel Queen: An icon of her own times yet looked down upon

ART news & views

Distance Between Art & It's Connoisseur

Volume: 3 Issue No: 14 Month: 3 Year: 2011

Market Insight

by AAMRA

Good news and bad news come hand in hand, as we enter the third month of 2011. The good news is based on figures while the bad news is, as always a matter of perception. First, the good news: In January, the art market watcher ArtTactic's confidence index has recorded a rise. According to its press release: “The ArtTactic Confidence Indicator for the US and European contemporary art markets saw an 11.6% increase in the last six months of 2010. The current indicator is now standing at 68 - just below the initial confidence level at the launch of the ArtTactic Confidence Survey in May 2005. ArtTactic reports that one of the key factors that has influenced the resurgence in market confidence is “the ability of the art market to absorb the large amount of supply hitting the auction block in November 2010. The contemporary evening sales in New York raised a total of $553 million, which was 38.4% higher than May 2010, and only 17% lower than May 2008 - the peak of the contemporary art boom.” Not only the secondary market, even the primary market has shown a considerable resurgence. The ArtTactic Primary Art Market Indicator saw a significant increase of 25.2%, which signals that there is renewed confidence in the primary market, after a difficult year in 2009. However, at this point, there is a need to stop and think. Let us put in perspective a few other facts.

According to a recent Christie's press release, “In 2010 online bidding via Christie's LIVE™ continued to deliver a large number of winning bids and new registrants. Over a quarter 28% of Christie's clients now bid online, a 5% increase on 2009 and the total value of lots sold online rose 69% to $114.4 million including premium.” If we decode the Christie's press release, the conclusion is simple. The internet has opened up a whole new aspect in the art market, and more and more  collectors are taking recourse to the phenomenon of virtual, or as the auction houses love to describe it, online bidding.

collectors are taking recourse to the phenomenon of virtual, or as the auction houses love to describe it, online bidding.

A few more illustrations in this respect will elucidate matters. The first major online art fair, the VIP art fair, was launched recently. In this part of the world (although when it comes to the internet, the world is one's oyster) Saffronart set the new record of any work of art sold online, when it sold Arpita Singh's Wish Dream at an extraordinary $ 2.24 million in December last year. There have been other developments too. A Chinese organisation of an online exchange for trading shares in works of art was also launched recently. This was a concept doing the rounds for quite a long time. Everybody thought about it, but never really put the concept in practice. It was therefore left to a little known Chinese town to come up with a government backed art-share trading website. The market, operated by the government-backed Tianjin Cultural Artwork Exchange (TCAE), is considered a financial innovation by the Tianjin municipal government. According to a Chinese government website: “As we are told, the greatest highlight of TCAE is “trading of artwork shares”, namely public market trading based on the shares of the property right owned after the subject matter is evenly divided into certain shares. The cultural artwork can be traded through the e-platform of the exchange after being divided into shares. Investors can extend investment channels through investment in artwork shares.”

Also getting on the fine art share stock exchange bandwagon is a French company called A&F Markets who launched their exchange in January 2011. According to a press release around the month of launch, “As of today, our clients will be able to see the first selection of artworks on the market, the price and volume of the shares available, discover how the marketplace works and what it offers and finally open an Art Exchange account in order to be the first to buy shares,” confirmed Pierre Naquin, founder of A&F Markets.”

In short, 2010 was a big year for the online art market that saw investors and collectors make progress into unchartered territory where they had previously feared to tread.

ArtTactic's economic component may still remain below the 50 level, after dropping 18.1% in the first half of 2010. This may suggest that the market is still concerned about the economic recovery in the US and Europe. According to their press release, “This is further supported by the fact that 63% of the respondents see the economic recovery as the greatest risk to today's art market.” But it is a fact that the same ArtTactic also notes that the confidence indicator has risen by 11.6%. One of the reasons may as well be the recourse to online biddings that more and more auction houses in Europe and America are taking. This has a two fold advantage. First, the bidder need not be present physically at the site of auction. Second, a bidder, if s/he so chooses can take part in more than one auction at the same time. While this definitely gives the auction houses an edge, and may perhaps have helped them recover from the slump, it is also a fact that this phenomenon is capable of alienating the bidder more and more from the piece of art s/he chooses to posses.

Nicholas Forrest, the Australia based art critic and founder of the artmarketblog.com, duly notes:“I am very glad that the art market has rebounded so quickly, but I am also extremely concerned about the way the art market is progressing. As I have mentioned many times before, the long term stability and viability of the art market is dependent upon the existence of a certain level of connection and interaction with the cultural sector, as well as certain level of participation from connoisseurs and collectors (as opposed to trophy hunters). Time and time again we see the art market take a dive when the value of art becomes so disconnected from the cultural and art historical value of the artists and their work that the only justification for the prices being paid is related to social status and egotism. At some point in the progression of an art market boom the purchase of fine art turns into nothing more than a game of one-upmanship- a game where a group of the super wealthy compete  with each other to see who is ultimately going to be the biggest fool! As much as the super rich like spending money, there is always going to be a point in time when even they think that the prices are too high and have to pull out leaving one lucky punter with the “biggest fool” award.

with each other to see who is ultimately going to be the biggest fool! As much as the super rich like spending money, there is always going to be a point in time when even they think that the prices are too high and have to pull out leaving one lucky punter with the “biggest fool” award.

Although the internet has had a positive effect on the art market, there is also the potential for the internet to further distance the connection between the cultural/art historical value of a work of art and the price being paid for a work. Think of it this way: the less exposure and interaction one has with the work they are purchasing, the less opportunity there is to analyse, assess and criticise those works. This leads to a very concerning situation where mediocre works by well known artists are being sold for prices that are way too high…”

Juxtapose Forrest's views with ArtTactic's figures. “The proportion of the respondent believing the market will move upwards in the next 6 months, increases from 31% to 36%.... (while) 16% believe the market will fall (up from 14% in June 2010). This goes on to show that buyers themselves are not actually sure as to how the market will shape up. And this happens when there is an increasing disconnection between the buyer and the object de art.

Market realities point to a worrying trend that has taken place in the first round of 2011. There is a noticeable resurgence in the interest of the work of artists who are, according to Forrest “boom time trophy hunter favourites such as Francis Bacon, Bridget Riley, Damien Hirst, Chris Ofili and Lucian Freud and others. Although it appears that buyers are remaining relatively conservative when it comes to purchasing works by these less “secure” artists, it is likely that it will not be too long before those irrational and indiscriminate demons rear their ugly heads.”

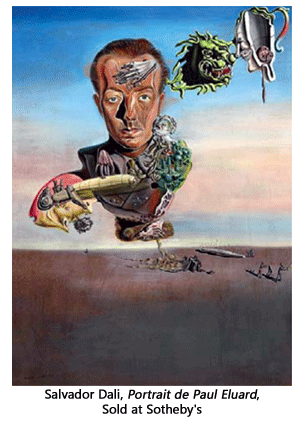

There is also a resurgence in the interest in Surrealist art. According to market analysts, when demand for Surrealist works increases dramatically, it goes on to prove that the market is once again seeking trophy works of art that provide instant visual gratification as opposed to an approach to the purchase of works of art that focuses more on scholarly factors. Facts illustrate this. Both Christie's and Sotheby's held sales during February that included a strong contingent of Surrealist works with Christie's going as far as to hold a separate Art of the Surreal sale alongside their February 9 Impressionist and Modern Art sale. Christie's held their big sale the night before Sotheby's and got the ball rolling with a new auction record set for a work by Pierre Bonnard and a new auction record for a work by Dali. Although Christie's set the Surrealist bar very high, Sotheby's replied with a new auction record for Dali with Portrait de Paul Eluard thus beating the Dali record set by Christie's the night before. The price paid for the Portrait de Paul Eluard was also a new auction record for any Surrealist work of art which gives Sotheby's Surrealism bragging rights over Christie's. That in fact is the worrying trend. If 2011 proves to be the year of growing disconnection between the work of art and its connoisseur, it may not be long before we look at yet another slump in the market. And that, despite ArtTactic's claim of an increasing Confidence Indicator.