- Prelude

- Editorial

- A Conversation with Sheela Gowda

- The DIY Artist with a Mission

- Discovering Novel Horizons

- A Conversation with Raqs Media Collective

- Manjunath Kamath

- Jitish Kallat- the Alchemist

- The Artist and the Dangers of the Everyday: Medium, Perception and Meaning in Shilpa Gupta's work

- An Attitude for the Indian New Media

- Weave a Dream-Theme Over Air or a Medium like Ether

- Installation in Perspective: Two Outdoor Projects

- Towards The Future: New Media Practice at Kala Bhavana

- Workshop @ Facebook

- Desire Machine: Creating Their Own Moments…

- Typography: The Art of Playing with Words

- Legend of a Maverick

- Dunhill-Namiki

- The Period of Transition: William and Mary Style

- The Beauty of Stone

- Nero's Guests: Voicing Protest Against Peasant's Suicides

- Patrons and Artists

- The Dragon Masters

- What Happened and What's Forthcoming

- Art Chennai

- Art Events Kolkata

- Winds of Change

- Art Bengaluru

- Mumbai Art Sighting

- Musings from Chennai

- In the News

- Previews

- Ascending Energy, Merging Forms: Works by Satish Gujral

- Re-visiting the Root

- The Presence of Past a New Media Workshop

- Taue Project

ART news & views

The Dragon Masters

Volume: 3 Issue No: 15 Month: 4 Year: 2011

Market Insight

by AAMRA

April is an interesting month, as it brings out interesting market trends. As the financial year 2010-11 closes, market reports are pouring in from various quarters. And what started as a flickering style in 2008-09, is now an established trendwhich we may well term as the rise of the sleeping dragon. The Dragon, as such, is breathing fire now. And how?

The Pundits at Art Market Insight were the first to be stunned. They were working on their usual annual Market Trends Publications to be published later this year, but while compiling the list of the best performers of 2010-11, one name floored them. Zhang Daqian. He ranked third in terms of total sales, after Pablo Picasso and Andy Warhol.

“There are no surprises at the very top of the ranking versus the previous year, with the two familiar pillars of the market occupying the top two places: Pablo Picasso and Andy Warhol. The third place is however more surprising, going to the Chinese artist Zhang Daqian, replacing Qi Baishi,” remarks Art Market Insight.

This is what the report states:

1 - Pablo Picasso (1881-1973): $361.5million

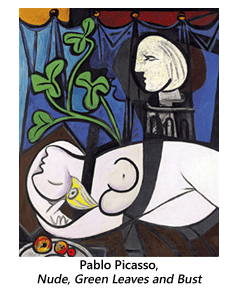

In Pablo Picasso's 2010 sales portfolio: the best art auction result of all time, i.e. 95 million dollars. This all-time record Nude, Green Leaves and Bust a lascivious painting of Marie-Thérèse Walter is $2m higher than his previous record for Garçon à la Pipe set in 2004. The work came from the Frances Lasker Brody collection and sold at Christie's on 4th May 2010 generating almost one third of the sale's total revenue ($296.5m from 56 lots sold). This spectacular sum is more than double the best auction result in 2009 generated by Raphael's drawing Head of a Muse ($42.9m at Christie's in London on 8th December).

In Pablo Picasso's 2010 sales portfolio: the best art auction result of all time, i.e. 95 million dollars. This all-time record Nude, Green Leaves and Bust a lascivious painting of Marie-Thérèse Walter is $2m higher than his previous record for Garçon à la Pipe set in 2004. The work came from the Frances Lasker Brody collection and sold at Christie's on 4th May 2010 generating almost one third of the sale's total revenue ($296.5m from 56 lots sold). This spectacular sum is more than double the best auction result in 2009 generated by Raphael's drawing Head of a Muse ($42.9m at Christie's in London on 8th December).

Apart from this historic result, there were plenty of other million-plus hammer prices: indeed, Picasso generated no less than 42 in 2010 vs. 15 in 2009 (a year in which the global art market posted a sharp contraction) and 39 in 2008 (the market was highly speculative until October 2008).

2 - Andy Warhol (1928-1987): USD 313.4 million

The sacred idols of the art market are the first to benefit from investors' new-found liquidity. In 2010, Warhol a veritable benchmark of the market, like Picasso tripled his somewhat mediocre auction performance of 2009. The King of Pop (whose auction revenue shrank by half in 2009 vs 2008) generated 40 million-plus results, five of which went beyond the 10 million dollar threshold! Although collectors the world over buy his works, the core of his market remains American (70% of auction revenue) and British (25% of auction revenue) and affordable since the market is flooded with affordable works: 40% of his works fetch less than €7,000.

The sacred idols of the art market are the first to benefit from investors' new-found liquidity. In 2010, Warhol a veritable benchmark of the market, like Picasso tripled his somewhat mediocre auction performance of 2009. The King of Pop (whose auction revenue shrank by half in 2009 vs 2008) generated 40 million-plus results, five of which went beyond the 10 million dollar threshold! Although collectors the world over buy his works, the core of his market remains American (70% of auction revenue) and British (25% of auction revenue) and affordable since the market is flooded with affordable works: 40% of his works fetch less than €7,000.

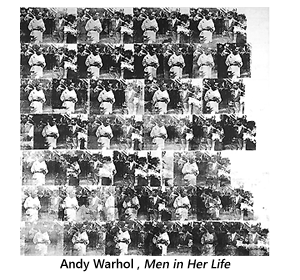

Men in Her Life, a major work from the Jose Mugrabi collection was his best result of the year. It sold for 56.5 million dollars at Phillips de Pury & Company. This single result generated nearly half of the revenue total at Phillips' 8 November sale 2010. Moreover, thanks to Warhol, Phillips signed its best-ever auction price, beating its former record by $7m (on 7 May 2001 at a New York Impressionist & Modern sale).

3 - Zhang Daqian.

Who is he? Daqian was born in 1899 and died in 1983, and in 2010-11, his works have posted a total sales value of 249.1 million US dollars. To quote Art Market Insight's March 11 post, “Zhang Daqian signed two six-figure results at Christie's Fine Chinese and Modern Paintings Sale on 30 November 2010 (in Hong Kong). The overall result from that sale was indeed spectacular as it generated a total of $60.58m and an exceptionally low bought-in rate (4.6% of the 239 lots offered). Three rolls by Zhang Daqian were presented: Temple at the Mountain Peak ($6.95m), Dwelling in the Qingbian Moutains ($3.6m) and Flying Deity ($3.35m) fetched three of his five top auction scores. Collectors have shown particular enthusiasm for his delicate ink-on-silk works since 17 May 2010 when his Achensee (76.2 x 264.2 cm, 1968) scored a new personal record equivalent to $13.2m at China Guardian.

Who is he? Daqian was born in 1899 and died in 1983, and in 2010-11, his works have posted a total sales value of 249.1 million US dollars. To quote Art Market Insight's March 11 post, “Zhang Daqian signed two six-figure results at Christie's Fine Chinese and Modern Paintings Sale on 30 November 2010 (in Hong Kong). The overall result from that sale was indeed spectacular as it generated a total of $60.58m and an exceptionally low bought-in rate (4.6% of the 239 lots offered). Three rolls by Zhang Daqian were presented: Temple at the Mountain Peak ($6.95m), Dwelling in the Qingbian Moutains ($3.6m) and Flying Deity ($3.35m) fetched three of his five top auction scores. Collectors have shown particular enthusiasm for his delicate ink-on-silk works since 17 May 2010 when his Achensee (76.2 x 264.2 cm, 1968) scored a new personal record equivalent to $13.2m at China Guardian.

This master of the Modern Era is being hungrily snapped up in Hong Kong (57% of his sales) and in China (40% of his sales). In New York, Sotheby's was the first auction house to include Zhang in its catalogues and sold his drawings for between $2,000 and $10,000 on average at the beginning of the 1990's. In 2010, the auctioneer was selling his works for between $20,000 to $750,000.

$2,000 to $20,000 in a span of twenty years is amazing by any standards. How did it happen? Look at where he is selling the most, Hong Kong and China itself. We had, in these columns earlier, touched upon how the Chinese patronisation has been on an upswing since 2008-09. This has mainly been due to nationalist feelings to say the least. Chinese patrons have had the money, even during the slump years and they have invested heavily on artists of their own country. A recent survey has exposed that during the last financial year; Chinese art investment has overtaken that of Britain and is way ahead of the next major European market France. A Reuters report, quotes The Global Art Market in 2010: Crisis and Recovery: “China's art market nearly doubled in 2010, and that its share of the global business hit 23 percent last year, overtaking Britain's 22 percent. That is still some way ahead of the next largest European market, France, which accounted for six percent. The United States remains the world leader with a 34 percent share.” But for how long?

This is a question raised by Art Market Insight, in its analysis of the best performer for 2010-11, Pablo Picasso: “The Picasso myth does not appear to have weakened, but will it resist the spectacular rise of Chinese artists up the global auction ladder?” True to its core, since the rise of Daqian is staring at our face, and there are other factors too.

The concern has been raised by The Global Art Market 2010 report, which has rued the fact of the European Union's decision to levy an art tax on auctions of artists who have died within 70 years from 2012.

The Reuters report states that, The Global Art Market in 2010: Crisis and Recovery underlined what auction houses and consigners had seen throughout last year -- a sharp rise in the number of wealthy Chinese buyers, and, with them, prices.

The report, commissioned by the European Fine Art Foundation, estimated the value of the global art and antiques market in 2010 at 43 billion euros ($60 billion), up 52 percent from 2009 when values slumped as a result of the financial crisis.

"The period from 2008 through 2010 has been one of crisis and recovery for the market for art and antiques," said the report.

"Luxury spending contracted sharply in many countries during 2009; however 2010 brought the first signs of economic recovery with a rebound in consumer confidence and with Chinese consumers driving growth in many luxury sectors."

The report highlighted concerns in Britain that an EU art tax due to be imposed in 2012 could further damage the country's ability to cope with increasing competition from abroad.

An EU levy on the sale of works by living artists was introduced in the United Kingdom in 2006, and, according to the British Art Market Federation, was a "significant factor" behind the country's declining share of the contemporary art market.

Under European Commission plans, in 2012 this levy is due to extend in the UK to sales of works by artists who have died within the last 70 years, affecting auction favourites like Pablo Picasso and Alberto Giacometti.”

And this will definitely affect Britain's position, say the pundits.

The same Reuter's report quotes Anthony Browne, chairman of the British Art Market Federation, who called on the government to take "firm action" in Brussels to ensure fair competition.

"The EU alone applies this levy -- it does not exist in China, the United States or Switzerland, our main global competitors," said Browne. "Unfortunately for us, the EU put the cart before the horse. It should have secured a global agreement ... before going it alone and introducing this surcharge in Europe," he added.

The art market report calculated the cost of sending works to non-EU markets for sale to avoid the levy, and found that it would be worthwhile for a vendor to send any work worth 40,000 euros or more to New York, or to Hong Kong perhaps, because that area also falls outside the purview of the EU levy reign.

And if that happens, it may have far reaching effects, because, although in America a Pablo Picasso or an Andy Warhol may still hold strong, there is no guarantee that they would find the same enthusiasm among Chinese patrons in Hong Kong, who would definitely prefer their own artists. At least as far as trends up until now go.