- Publisher's Note

- Editorial

- Love of Life (that) Spills Over

- A Continuing Multiplication

- From Painting to Print

- Intimate Involvement

- Portrait of the Artist as an Old Man

- (Hi)Story of the Garhi Printmaking Studios, New Delhi

- Surinder Chadda

- Ramendranath Chakravorty

- Group 8

- Mother and Child: A Screenplay

- Straddling Worlds

- A Brief History of Printmaking at Santiniketan

- Vignettes from History

- Southern Strategies

- The Forgotten Pioneer: Rasiklal Parikh

- Printmaking in the City Of Joy

- Amitabha Banerjee: His Art and Aesthetic Journey

- Local Style and Homogenizing trends: Early Medieval Sculpture in Galaganatha

- English China: Delicate Pallid Beauty

- The Beauty of 'Bilal'

- Photo Essay

- The Way of The Masters: The Great Artists of India 1100 –1900

- Striving Towards Objectivity

- The Art of Sculpting In the Contemporary Times

- An Artistic Framework for an Alternative to Ecology

- Bidriware and Damascene Work in Jagdish and Kamla Mittal Museum of Indian Art

- A Lowdown on the Print Market

- The 'bubble' and the 'wobble'

- What Happened and What's Forthcoming

- Art Bengaluru

- Art Events Kolkata: June – July 2011

- Musings from Chennai

- Mumbai Art Sighting

- Previews

- In the News

- Christie's Jewellery Auction at London, South Kensington

ART news & views

A Lowdown on the Print Market

Volume: 3 Issue No: 19 Month: 8 Year: 2011

Market Monitor

by Sarmistha Maiti

Printmaking as a part of Fine Arts has a long trail in the history of visual arts for at least two centuries with substantial evidences worldwide. Though it initially had onset with a versatile quality of treatment in the execution of creativity but the possibility of exact replica somewhere reduced its denomination in the art world as copies of the same work of art could be easily created. But things don't remain the same always and in the latest evaluation of the worth of art, the statistics have proved to be something else. What was considered a lesser art, and for some no art at all, has suddenly come into prominence in the market. Signature prints have always had a market though, especially works by Japanese and Chinese printmakers. These types of prints are numbered and documented and therefore have always enjoyed a steady, if somewhat modest market because of their rarity, or more precisely for the limited copies that lifted them up to the status of becoming phenomenon. However, mechanical prints that are prints which are mass produced through the mechanical means, usually of a particular artwork have come to prominence only of late.

In its June 22, 2011 edition, the New Delhi-based daily Pioneer carried an article on the emerging market of prints in India. In that article, Shivani Chawla, owner of the Chawla Art Gallery had said that the market for printmaking has improved in the recent past so much so that after some time the value of some prints “reaches the same as that of the actual copy.”

The article further quotes some more experts in the printmaking industry. “With a motive to reach out to public through a wide range of fine prints which are original, affordable and made by renowned print artists, Limited Edition, an art house, is trying to make these prints (a) viable investment option for art collectors.” “It's not that prints were not in demand earlier but people, at large, remained unaware of it,” says Radhika Dhumal from Limited Edition. But the good thing, she adds is that, “People who bought prints 10 years back for a meager sum can now sell them for 10 times its original price. Prints are increasingly becoming a good investment option.”

Well there is a flip side in the reproduction of the prints with the intervention of the digital medium. If we say The Graphic world of M F Husain, such a heading will immediately entice any art lover and art collector to think about prints done my Husain himself even if they have been replicated and reproduced in large numbers. Same applies for other maestros like Sakti Barman, Satish Gujral and so on. Now Husain in his entire career has never made a single print. Now the graphic world of Husain is the conversion of Husain's paintings into silkscreen prints where Husain puts his original signature.

To quote Husain, “Silkscreen print is like the silk route to satisfy people's need of collecting works of art, as original paintings are incapable of reaching the common mass. They say a thing of beauty is a joy forever (here you change the word ever to everybody). And the place where everybody can enjoy the work of art is an art museum. Da Vinci's Mona Lisa can't be kept in private homes, she belongs to the world. Thus graphic is a social art form…” This entire endeavour sounds pretty interesting and appreciating that propagates a significant message to cater a broader canvas of concern justifying social responsibility through aesthetical orientation. At least getting the Husain's paintings in the print forms is an experience altogether. But what should be the value of such prints and how are they indeed being priced? The question is very important in the evaluation of the artwork in the art market. Can one Husain signature or any other maestro's/ legendary artist's signature on his or her silkscreen prints of paintings can be equated as original prints or even their replicas. Of course not! Then how are the prices of such prints made through the innovation of technology, taking digital image and then reproducing those paintings in silkscreen prints being rated in lakhs and even more in the Indian currency!

When a print-lover like Radhika Dhumal herself, says that prints are not just mechanical reproductions, “They are the artists' direct response to the medium, experience and as valid as a painting or a sculpture. They make for a sound investment for those who are interested in buying these prints and who are educated about the art of printmaking”, that indeed makes sense and is a portrayal of a valid message to the art collectors in the understanding of what graphical art in fact means and what should be the worth of such art in making an investment. But when the artists have never made prints and their graphical art is being sold in the market in a price much higher than it should actually be, just because of an original signature like an AUTOGRAPH, is it valid and ethically correct; the art world should introspect and logically rethink to decide upon such evaluation and marketing strategy!

“Prints that are signed, numbered and audited, investors have realised, are not to be missed” says art collector and industrialist Ajay Gupta, “A decade back, only MF Husain's prints could fetch a few thousands but printmaking has increased over a period of time and from the investment point of view, it is a very good option.” Gupta has recently bought a print of SH Raza and calls them “as good as the originals.” But at the same time Gupta also warns, “Make sure that they are of limited editions as they are of greater value. Nothing but these limited edition prints can reach the level of original art.”

So, buying a secondary inkjet print that most artists are churning out today in India as a secondary avenue to income; would be a disaster for the investor. Of course, the final decisionof what you buy and whyrests upon you. If it is merely for decorating the home, and the pocket pinch is a little too much, even inkjets will do. As for investment, look out for the limited edition signatures.

Anupam Sood, a printmaker based in Delhi, notes another interesting point. “All prints are priced equally and hence, all works are the same irrespective of the number of editions,” she says. This is exactly what printmaking is all about where number of editions is reproduced by the artist and hence the price can be the same.

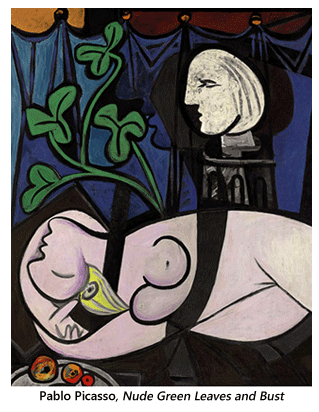

The print-market has increased in India and Indian collectors are slowly, but surely warming up to the potential of the printmaking market. Investment-wise too, prints come a lot cheaper than paintings. To give a nugget of information, the highest priced print in the world, by the 18th century Japanese artist Utamaro Kitagawa has clocked US $ 230,000 in a Christie's auction on March 23 this year. It is 38.7 cm x 26 cm and is a woodcut in colours. Compared to Utamaro's work, the highest priced original art work Nude, Green Leaves and Bust, by Pablo Picasso, which at the moment holds the record for the highest priced piece of art in the world was sold for a staggering US$ 95,000,000 which is a oil-on-canvas measuring 162cm x 130 cm. Given that Utamaro's works are hard to come by, majorly limited, and absolutely handmade prints, done in an age when the notion of mass printing was absent, $230,000 is a steal. But that is the maximum that the 'lover of Geishas' has commanded up till now.

As far as records go, prints can cost as low as US$ 5,155. This one was clocked by Joan Miro, last year for his etching, aquatint measuring 12.5 cm x 14.9 cm in spite of the fact that Joan Miro is described as “one of the creative giants  of 20th century art. Drawing on his fantastic universe of signs and symbols, he was able to create a magical world populated by strange configurations in vivid colours. He made many prints throughout his career, their accessibility being strongly in keeping with his socialist principles.

of 20th century art. Drawing on his fantastic universe of signs and symbols, he was able to create a magical world populated by strange configurations in vivid colours. He made many prints throughout his career, their accessibility being strongly in keeping with his socialist principles.

Most experts now agree to the fact that prints are a more secure investment option. Nicholas Forrest, the prolific writer of the artmarketblog comments. “For the same price as a mediocre painting by a relatively unknown artist I could pick up three awesome limited edition prints by some of the most desirable Aboriginal print makers. (He was, in this instance referring to a particular exhibition of Australian Aboriginal printmakers). What sparked my interest even more was the fact that most of the prints were by artists who are known first and foremost as print markers as opposed to, say, painters that transfer their images to prints. By purchasing a limited edition print by an artist who is best known for their print work I am making a much better investment than if I was to purchase a work by a painter who produced prints. The reason for this is that the primary medium that an artist works with is always going to be more desirable than a secondary medium which printmaking often is. Printmaking is often seen as being a lesser form of art because most artists use printmaking as a secondary source of income but there are still plenty of artists out there who are primarily print markers. By purchasing works by such print markers you are not only making a good investment but you are able to purchase much better quality works for much less money.”

In fact, 'artprice' in one of its earlier posts, had commented that the best investment for prints will be in the mid-level section, where you pick up primary prints selecting new and upcoming printmakers, rather than investing in mass produced secondary prints of artworks by well-known artists. One of the reasons forwarded by this article is that this is a safer bet. You do not spend a fortune; in fact chances are you get it at a bargain. At the same time, signature prints will automatically increase in value over time and are therefore worthwhile investments in terms of returns. In the same article, 'artprice' had noted that mid-level primary prints have enjoyed a better market than high-level prints.

In the final analysis therefore, investing in prints seems to be the most viable option, especially for entry-level collectors. To end, we quote the same Pioneer article.

“The increase in value has had a direct effect on the status, prints being near to original artworks. Agrees Anupam Sood, “Printmaking is original art now and half the enquiries will be over if one makes an effort to understand that even if an artist takes out 40 editions, the physical labour and hard work is the same. Hence, the artwork is as good as an original.”