- Publisher's Note

- Editorial

- Love of Life (that) Spills Over

- A Continuing Multiplication

- From Painting to Print

- Intimate Involvement

- Portrait of the Artist as an Old Man

- (Hi)Story of the Garhi Printmaking Studios, New Delhi

- Surinder Chadda

- Ramendranath Chakravorty

- Group 8

- Mother and Child: A Screenplay

- Straddling Worlds

- A Brief History of Printmaking at Santiniketan

- Vignettes from History

- Southern Strategies

- The Forgotten Pioneer: Rasiklal Parikh

- Printmaking in the City Of Joy

- Amitabha Banerjee: His Art and Aesthetic Journey

- Local Style and Homogenizing trends: Early Medieval Sculpture in Galaganatha

- English China: Delicate Pallid Beauty

- The Beauty of 'Bilal'

- Photo Essay

- The Way of The Masters: The Great Artists of India 1100 –1900

- Striving Towards Objectivity

- The Art of Sculpting In the Contemporary Times

- An Artistic Framework for an Alternative to Ecology

- Bidriware and Damascene Work in Jagdish and Kamla Mittal Museum of Indian Art

- A Lowdown on the Print Market

- The 'bubble' and the 'wobble'

- What Happened and What's Forthcoming

- Art Bengaluru

- Art Events Kolkata: June – July 2011

- Musings from Chennai

- Mumbai Art Sighting

- Previews

- In the News

- Christie's Jewellery Auction at London, South Kensington

ART news & views

The 'bubble' and the 'wobble'

Volume: 3 Issue No: 19 Month: 8 Year: 2011

Market Insight

by AAMRA

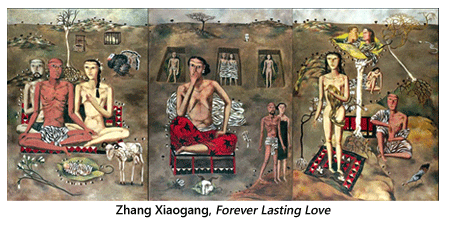

Two veteran art market commentators have been leaving us confused of late. While in Australia, Nicholas Forrest has been vociferously criticizing the workings of Chinese auction houses, down in Delhi, John Elliot, the India-based British journalist has been noting that the Chinese market is definitely able to garner a solid international recognition. On June 23 Elliot wrote in his blog, ridingtheelephant.wordpress.com that, “…despite its earlier boom, Indian art has never captured China's level of international attention. A China record of $10.2m, more than three times India's highest-ever price, was paid at a Sotheby's Hong Kong auction in April for a three-panelled (triptych), Forever Lasting Love, by Zhang Xiaogang, a top contemporary mainland Chinese artist.

By contrast, Subodh Gupta, who leapt to the forefront of Indian contemporary artists in the mid-2000s with paintings and installations of shiny pots and pans and other apparent aspects of modern Indian life, has not done well. Last year in London an untitled 67x90" oil on canvas of an airport luggage trolley fetched only £180,000 ($250,000) at Sotheby's, which was about a fifth of a 2008 price for a very similar trolley.”

Elliot in this case was discussing the recent wobble that top-end Indian artists like Raza, Souza and Husain are facing in the international market. However, while comparing the Indian artists and Chinese artists, Elliot gives the latter a definite edge of superiority.

Compare that to Nicholas Forrest's delineation of the Chinese market. In a July entry this year, in his blog artmarket.com, Forrest, explaining the way the Chinese market works, writes, The true “value” of an artist's work is something that is developed over a long period of time and is primarily a reflection of - among other things- their cultural and art historical importance, the influence that they have had on their chosen genre and medium, and the results of critical review. As an artist's career progresses through various stages of development, the dollar value of their work also develops and pro-gresses. Prior to appearing at auction, artists usually sell their work through private commercial galleries which helps create a stable and justifiable price point for their work. One of the problems facing the Chinese art market is that China has an underdeveloped private gallery system that cannot support the number of contemporary artists being thrust into the limelight at such a rapid rate. Many Chinese contemporary artists are skipping the private gallery stage of their career and going straight to auction which makes the value of the work much more unstable and unjustifiable over the long term.

What makes valuing works of art so difficult is that there are two types of value that are especially relevant to the Chinese art market. The first value is the true artistic value of the work of art and the second value is the prestige and social status that comes with owning a piece of expensive fine art. Are the works of art being sold worth what people are paying for them from a market/artistic value? The answer would have to be no for two reasons, the first of which is that many Chinese buyers are being driven by a desire for social status and prestige. Secondly, many of the artists whose prices are being driven to extreme heights do not have the career credentials to justify the prices being paid. Are the works of art being sold worth what people are paying for them from a social status/prestige perspective? The answer to the question would depend on what effect the work of art has had on the social status and prestige afforded to the owner. Only the owner can answer this question as there is no way of qualifying or quantifying the value of social status and prestige.

''Because the value of social status and prestige cannot be qualified or quantified, and because such value is in no way inherently attached to the work of art, the likelihood of the massive prices being paid for works of art by Chinese artists remaining at the level they are currently at is very low.”

Forrest's explanation points towards only one direction. That the Chinese art market boom is more of a bubble, which will, in due course burst. In that light, Elliot's argument, that the Indian artists are not performing well vis-à-vis their Chinese counterparts, seems a very superficial observation going just by the results of auction houses.

The truth of the matter is actually simple. Prices depend a lot on the financial equitability of patrons. It is to be noted that China at this moment is solidly ensconced in terms of GDP while inflation and an unstable market has been the bone of contention in India for quite a couple of years now. Now, patrons of Chinese art are generally Chinese, and with state-sponsored galleries like China Guardian making their presence felt worldwide, the media focus on Chinese art is on the increase. This is positively affecting the size of the market and thus prices of most top-end Chinese artists are stable. Compared to that, India has no state-sponsored galleries as such, which deal in the commercial aspect of art. Private galleries are shy of risking too much. And a lot of Souza and Raza have been circulating in the international market of late, especially after both of them performed very well last year with Raza achieving the highest price by any Indian till date. This veritable supply-base has obviously affected the pricing of these artists, since at this moment the demand is not that high.

Our argument will be established by one small nugget of information. Tyeb Mehta has been performing at a very steady pace over this period. Elliot himself writes, “A different sort of record was set (in June) by Mehta with Kali, which received a bid of $1m (on its way to a $1.31m sale) through a mobile-phone bidding application on Mumbai-based Saffronart's on-line auction. Bids (successful and unsuccessful) totalling $3.86m were received on this mobile route, which Saffronart says is unique among leading auction houses.”

By the way, Mehta died in 2009 and his works are not only distinctive in terms of style but he was also not as prolific as his other Progressive Artists Group contemporaries like Raza, Souza and Husain. His works, therefore, are not that easy to come by.

We rest our case.