- Publisher’s Note

- Editorial

- Progressive Artists Group of Bombay: An Overview

- S. H. Raza: The Modern

- Ara: The Uncommon Commoner

- Art of Francis Newton Souza:A Study in Psycho-Analytical Approach

- M.F. Husain: An Iconoclastic Icon

- Husain’s ‘Zameen’

- Life and Art of Sadanand Bakre

- Hari Ambadas Gade: Relocating the Silent Alleys

- Mysticism Yearning for the Absolute

- Modernist Art from India at Rubin Museum of Art, New York

- Traditional Art from India at the Peabody Essex Museum

- Nandan Mela 2011: A Fair with Flair

- India's First Online Auction of Antiquities

- The Market Masters

- Markets May Plunge and the Rich May Flock To Art

- What Happened and What's Forthcoming

- Random Strokes

- Julian Beever: Morphing Reality With Chalk Asthetics

- Eyes on Life: Reviewing Satish Gujral’s Recent Drawings

- Exploring Intimacy: Postcards of Nandalal Bose

- Irony as Form

- Strange Paradise

- Eyeball Massage: Pipilotti Rist

- René Lalique: A Genius of French Decorative Art

- The Milwaukee Art Museum – Poetry in Motion

- 9 Bäumleingasse

- Art Events Kolkata: November – December 2011

- Art Bengaluru

- Mumbai Art Sighting

- Delhi Dais

- Tacita Dean at Turbine Hall, Tate Modern, London

- Preview: January, 2012 – February, 2012

- In the News: December 2011

ART news & views

Markets May Plunge and the Rich May Flock To Art

Issue No: 24 Month: 1 Year: 2012

Market Insight

by AAMRA

With unemployment, euro zone debt crisis, dollar-fall and fringe movements like Occupy Wall Street crossing the seas and going viral through two continents, it is not really on a happy note that 2012 is being heralded economically. Stock markets all over the world have been wobbly all through 2011 and the predictions for 2012 are not very bright. Real estate is also suffering a similar fate, ever since the Lehman Brothers collapse. To put it in perspective, the worst effects of the meltdown of 2007-08 is yet to pass us by. Economies are now connected and ripple effects take time to materialize in the huge matrix that is world economy. Despite the bullish hopes on which 2011 had tried to canter, chinks are already showing in that armour of economic confidence.

With unemployment, euro zone debt crisis, dollar-fall and fringe movements like Occupy Wall Street crossing the seas and going viral through two continents, it is not really on a happy note that 2012 is being heralded economically. Stock markets all over the world have been wobbly all through 2011 and the predictions for 2012 are not very bright. Real estate is also suffering a similar fate, ever since the Lehman Brothers collapse. To put it in perspective, the worst effects of the meltdown of 2007-08 is yet to pass us by. Economies are now connected and ripple effects take time to materialize in the huge matrix that is world economy. Despite the bullish hopes on which 2011 had tried to canter, chinks are already showing in that armour of economic confidence.

And hence, it is therefore time to sit back and see what your investment portfolio should mean in this New Year —if there are newer avenues that you may perhaps consider.

It is in this light that a December 2011 investment report by Reuters, dealing mainly with the Asian art and valuables market, with special focus on China, becomes an interesting study.

It is a long report, and one part, with a subtitle of ‘Safe Haven’ goes like this:

“While art often comes straddled with hefty commission, storage and insurance costs, it can serve as a fun portfolio diversifier, mixing decent returns with aesthetic pleasure.

Even as the euro zone debt crisis rages and buffets regional stock markets, the Mei Moses Global Art Index, a widely tracked art indicator, showed an 11.8 percent rise in 2011 to November.

"It may not be a good time for sellers but it's an excellent time for buyers. During late 2008 and 2009, I highly advised clients to buy," said Bobby Mohseni, director of MFA Asia, an art consultancy. "With Chinese contemporary art, some prices have gone exceptionally high and that's just over a decade ... so it's best to look at upcoming or mid-tier artists."

While stocks on the S&P 500 have outperformed Western art over the past 25 years, according to Mei Moses data, top Chinese and Asian art is still comparatively cheap compared with Western impressionists or American contemporary art. A Mei Moses index for traditional Chinese art showed a 24 per cent jump in the first three quarters this year.

"The confidence in the Chinese contemporary art market remains high despite art market confidence dropping sharply in the U.S. and European contemporary market," Anders Petterson, head of art research consultancy ArtTactic, told Reuters.

Even for those with less purchasing muscle, experts say bargains can still be had in less spotlighted categories, including modern Filipino and Indonesian painters, as well as photography, and Chinese snuff bottles, to name a few.

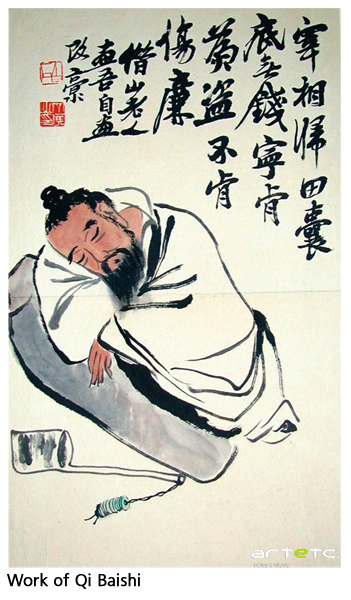

"Collect what other people aren't collecting," said Tony Miller, a former top Hong Kong government official and long-standing collector of scholars' objects and Chinese art. "If you can't afford Qi Baishi paintings and they're going at HK$2 million a throw, well, go for prints."

Qi is one of the masters of inkbrush paintings and his pieces sell for millions of dollars.

Owners of Hong Kong's art galleries, many of them crammed along the winding Hollywood Road in the Central district, say timing is the key.

"If you get good works of art, then without any question it is (a safe haven) but it doesn't have the liquidity. That's the difficulty," said Sundaram Tagore, whose galleries in Hong Kong and the United States feature a stable of culture-bridging artists. "If you're trying to sell at the wrong time it becomes part of the distressed market but if you're selling at the right time then you could make 100 times more, maybe more than property or any bonds can provide you.”

It is not just art that investors are looking at now. More and more auction houses are turning their focus on jewellery, wines, watches et al. And here too, it is the Hong Kong market that’s taking the lead. As the Reuters report suggests—“The search by Asian investors for alternative assets has extended beyond art into wine, gems, watches, postage stamps and other memorabilia -- the rarer and more exclusive, the better.

With about two-thirds of the world's stamp collectors in Asia, the stamps and collectibles market has surged, says Geoff Anandappa of stamp and memorabilia retailer Stanley Gibbons.

Hong Kong-based InterAsia Auctions -- which specialises in Asian stamps -- broke world records for Chinese stamps in September, raking in $12.6 million over four days. A 1941 Dr Sun Yat-Sen inverted centre stamp fetched $221,000, up 66 percent from a similar sale a year ago.

Chinese and Asian buyers have cornered the fine wine market, with a Hong Kong Acker Merrall & Condit wine auction in December bringing in $9 million, including a single superlot of 55 Romanee Conti vintages that fetched a record-breaking $813,000.

Similarly, Asian buying is behind the boom for diamonds and gems. China is on course to become the world's top diamond buyer and retailers in Hong Kong report a rise in the number of men coming to buy loose diamonds for investments.

A Hong Kong jewellery retailer recently raised $2 billion in one of the city's biggest initial public offerings this year to fund expansion in the region.”

However, in a market that is based more on whims than on rationality, there is a downturn to all this focus shifting onto Asia. After all, in the long run, this may not be a healthy sign, simply because the dynamics are lopsided.

According to a Deloitte report in collaboration with ArtTactic titled ‘Art and Finance 2011’, published in December 2011, which had tried to look for the first time at the relation between the investment market and the luxury market through an independent survey, the Chinese market is yet to come a long way in terms of fixing up the investment-matrix.

It says in the section titled ‘Global shift as China becomes the second biggest art market in the world in 2010’—“However, the rapid growth of China’s art market is not without its problems. A number of forgeries and fakes are finding their way onto the auction market which runs the risk of undermining market confidence. Also, recent figures released in September 2011 by Chinese Association for Auctioneers suggest that 40% of the US$1 million-plus works remain unpaid after six months (which by law is the longest credit period allowed). This questions the credibility of the domestic auction data as a source for estimating the size of the Mainland Chinese auction market since there is a high probability that many of these works will never be paid for.”

This was exactly the point that Australian art critic and blogger Nic Forrest had raised earlier in 2011, and which we at ArtEtc News & Views had discussed in quite some detail in these columns.

Be that as it may, the very fact that a world-famous investment consultancy firm like Deloitte thinks it the right time to bring out a detailed report on art-investment is also a silver lining in the mostly gloomy climes of the world art-market. It goes on to establish further what the Reuters report observes—that art finally has achieved serious investment status, and is on the cusp of becoming an alternative investment instrument – which is fun as well as more aesthetic— the world over.

If that is going to successfully happen or not will depend on the market dynamics of 2012.