- Prelude

- Editorial

- A Conversation with Jagdish Swaminathan

- Seeing is Very Important………

- Tormented Delineations and Violent Deformations

- Bikash Bhattacharjee: Subverting the Seen

- Bridging Western and Indian Modern Art: Francis Newton Souza

- Contesting National and the State: K K Hebbar's Modernist Project

- The Allegory of Return into the Crucial Courtyard

- Knowing Raza

- The Old Story Teller

- Beautiful and Bizarre: Art of Arpita Singh

- Feeling the Presence in Absence! Remembering Prabhakar Barwe

- Waterman's Ideal Fountain Pen

- Peepli Live: the Comic Satire Stripping off the Reality of Contemporary India

- Age of Aristocracy: Georgian Furniture

- Faking It - Our Own Fake Scams

- Scandalous Art and the “Global” Factor

- The Composed and Dignified Styles in Chinese Culture

- Visual Ventures into New Horizons: An Overview of Indian Modern Art Scenario

- The Top, Middle and Bottom Ends

- Top 5 Indian Artists by Sales Volume

- What Happened and What's Forthcoming

- The Month that was

- NESEA : A Colourful Mosaic

- Mumbai Art Sighting

- Art Events Kolkata

- Musings from Chennai

- Art Bengaluru

- Khoj, Kolkata Boat Project

- What a Summit!

- Ganesh Haloi at Art Motif

- The Other Self by Anupam Sud at Art Heritage, New Delhi

- Baul Fakir Utsav at Jadavpur

- Printmaking Workshop

- World's Greatest Never Before Seen Toy and Train Collection

- Previews

- In the News

- Christies: Jewellery Auction at South Kesington, London

ART news & views

Top 5 Indian Artists by Sales Volume

Volume: 3 Issue No: 13 Month: 2 Year: 2011

Market Monitor

by Art Bug

On January 1, 2011, The Times of India published a survey of spending patterns among Indians which aimed at predicting projected net spendings on various sectors in the new year. As expected, the greatest growth potential was observed in the telecom sector. But what was surprising  was that a close third in the group was the luxury sector, recording a 20 per cent growth.

was that a close third in the group was the luxury sector, recording a 20 per cent growth.

The luxury sector, according to market analysts is not a primary spending sector, and when it shows a growth potential only third to such basic necessities as telecom and housing in a developing country like India, it only points to one thing a solid growth in the secondary market and a spurt in surplus, which can only happen in a healthy GDP scenario. And that is good news to the Indian art fraternity, since art investment, in India at least, is a top-of-the-order secondary market phenomenon.

Actually, Indian art has become one of the most sought after alternative investments in the world. It is felt that compared to the stratospheric prices touched by western contemporary art, where Mark Rothko and Andy Warhol sells for astronomical prices, Indian art prices have a very long way to go to reach their peak. Research shows that, conservatively, Indian art is undervalued by five times and 10 to 15 times if compared to its western equivalents.

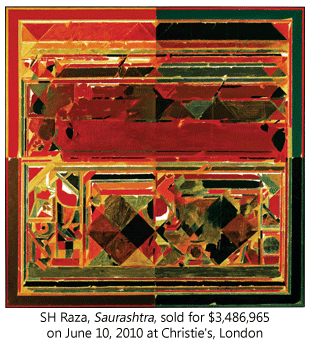

The highest price fetched by an Indian artist hovers around the $ 3.49 million, which was achieved last year by Sayed Haider Raza's Saurashtra. Compare that with prices fetched by Warhol on a regular basis,  which has been around $ 63.35 million last year. And to think that compared to Warhol's factory style of working, Raza's style will be nothing more than cottage industry, thus guaranteeing a greater chance of being unique.

which has been around $ 63.35 million last year. And to think that compared to Warhol's factory style of working, Raza's style will be nothing more than cottage industry, thus guaranteeing a greater chance of being unique.

It is therefore not out of place, when Rajiv Chaudhuri, a New-Yorker of Indian origin who has been a pioneer in setting up an Indian art fund abroad says, "If you look at Indian art from a purely financial perspective, I would say it's cheap relative to Western or even Chinese art ... [Mehta] is one of India's finest painters of the 20th century. The reality is that average artists from the West routinely sell for $5 million to $7 million. And by the way, Mehta painted only 200 works in his entire life. Andy Warhol probably did 200 every six months...” This was way back in 2005.

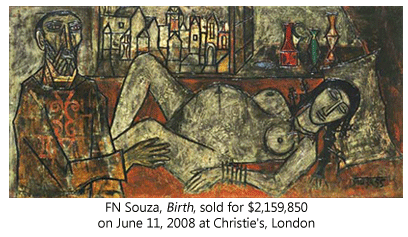

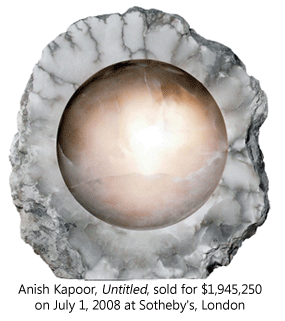

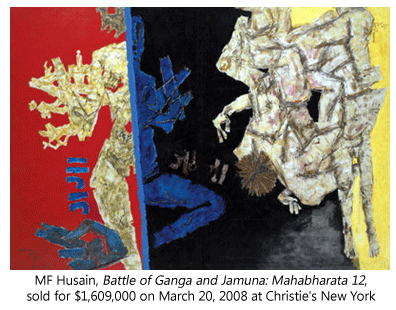

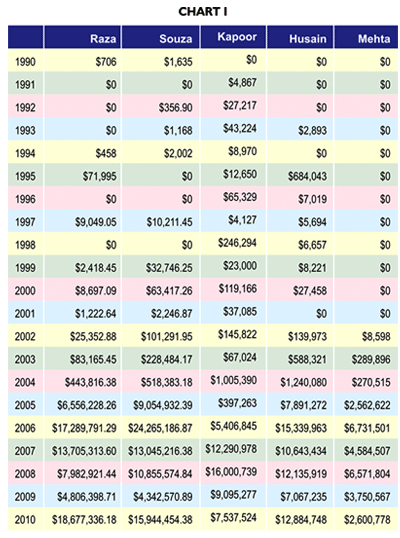

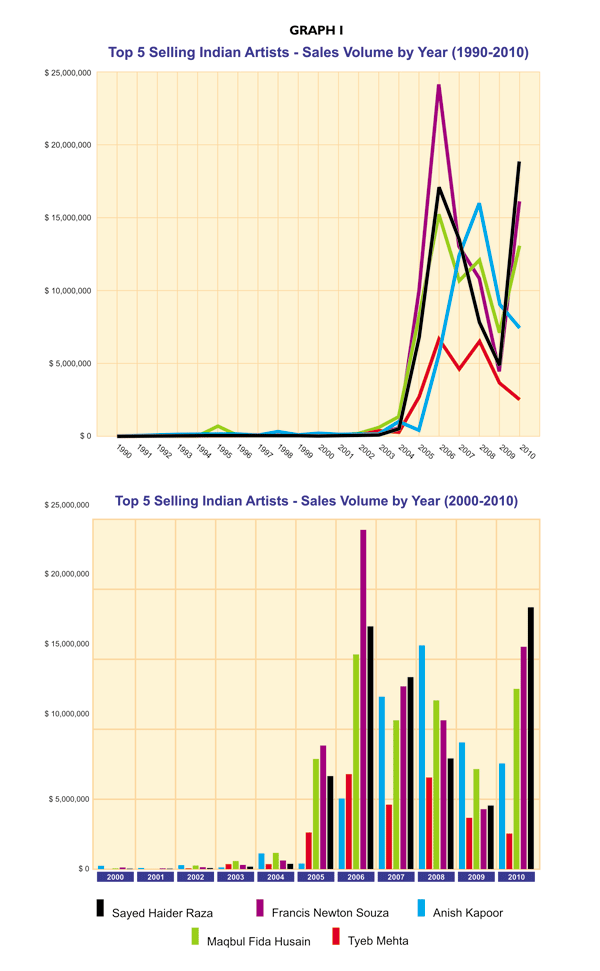

In perspective, the five best Indian artists in terms of global sales volume during the last decade have been Anish Kapoor, Tyeb Mehta, MF Husain, Souza and Raza. And collectively,  their best years have been between 2006 and 2010. Despite the global economic downturn, which took its toll between 2008 and 2009, these five have commanded a more or less fixed pricing, with a slight dent only in 2009, which between them, they collectively recovered in the very next year. Out of the five, as has already been said, Raza is still now the highest priced, though it is Souza who had commanded the best price in terms of works sold and value generated in a given year which stands at an impressive (by Indian standards) $24,265,186.87 in 2006. (Table 1)

their best years have been between 2006 and 2010. Despite the global economic downturn, which took its toll between 2008 and 2009, these five have commanded a more or less fixed pricing, with a slight dent only in 2009, which between them, they collectively recovered in the very next year. Out of the five, as has already been said, Raza is still now the highest priced, though it is Souza who had commanded the best price in terms of works sold and value generated in a given year which stands at an impressive (by Indian standards) $24,265,186.87 in 2006. (Table 1)

However, among the five, the first artists to have burst onto the International scene were Souza and Raza, who sold their works way back in 1990 followed closely by Kapoor whose first documented sale had been in the following year. But compared to those early days, when these Indian stalwarts went for anything between a few hundreds (Raza was priced at $706 in 1990) and few thousands (Souza was at $1635 in 1990 and Kapoor at $ 4867 in 1991) they have definitely come a long way.

In 2007 the Indian art market was $450 million, an increase of 29% on the previous year. Around 2009 the value of the global Indian art market was in the region of $2-3 billion and growing rapidly. Today, this represents a tiny fraction, approximately 6 to7 per cent of the $30 billion global art market. Hence the upside potential is impressive.

Hence the upside potential is impressive.

Arun Vadhera, Christie's consultant in India and owner of Delhi's Vadhera Art Gallery has been quoted by the media that he doesn't think Indian art is anywhere near its peak. On the contrary, it is at the same stage as technology was in the late eighties and early nineties. According to a research conducted recently, art experts are comparing the boom in Indian art to that of the similar boom in Chinese art which began in the 1980s, fuelled by a rising economy and a newly-rich Chinese community.

The rise in interest in Indian modern and contemporary art has been due to two reasons. On the one hand, there is a rapidly growing Indian (both NRI and Indigenous) collector base, as was evident from the prices Rabindranath Tagore's sketches fetched in the Sotheby's auction last year. On the other hand the artistic significance and commercial importance of Modern and Contemporary Indian Painting has now been discovered by the likes of the English billionaires  Charles Saatchi and Frank Cohen, and the French luxury brand czars Francois Pinault and Bernard Arnault.

Charles Saatchi and Frank Cohen, and the French luxury brand czars Francois Pinault and Bernard Arnault.

Francis Newton Souza, was collected and promoted, initially by Victor Musgrave at Gallery One (London) and by the American Harold Kovner. From the 1960s to the 1990s, the Americans, Chester and Davida Herwitz travelled yearly to India to acquire new works of art for their collection of Indian contemporary art. They developed close friendships with many of India's leading artists, particularly MF Husain, has been pointed out as they have done for Indian art what no Indian industrialist has been able to do. And their aim was not to decorate offices, but to be involved in the Indian contemporary art movement.

Today, with the new breed of contemporary Indian artists, like Subodh Gupta, Raqib Shaw and Anish Kapoor, also comes the new breed of promoter and collector. This is already transporting the whole sphere of Contemporary and Modern Indian art to a new, higher level of international marketing and collecting. Gupta is often referred to by the western and Indian art critic fraternity as the 'Damien Hirst of India'. This in itself speaks volumes of a familiar attempt to equate to a modern counterpart phenomenon of the West. In Gupta's case, one of his promoters, Delhi-based former New Yorker Peter Nagy, is part of the immediate cutting edge of Contemporary Indian painting.

It is thus not hard to comprehend the way the top five Indian artists have fared in the global market.  (Graph 2) From a 'jumpy' start in the mid-nineties, they have soared to their highest limits (till today) in 2005-2006 and have then taken a fall. However, except for Mehta and Kapoor, all the rest have seen a sharp rise in 2010, once the market gained in confidence.

(Graph 2) From a 'jumpy' start in the mid-nineties, they have soared to their highest limits (till today) in 2005-2006 and have then taken a fall. However, except for Mehta and Kapoor, all the rest have seen a sharp rise in 2010, once the market gained in confidence.

A comparison of the price graphics among Indian artists and their more well known global counterparts will show that their rise after recession has been sharper than the latter. This is because of their price differential, as Indian artists, even after two decades in the world market (considering from 1990 till 2010) are still undervalued and hence more readily capable of overriding the hammer price by a larger margin. However, Kapoor's and Mehta's inability to ride the crest of 2010 is also significant. Reasons, feel art market insiders are 1) Mehta's inability to market himself. He started off late and he never really sought a promoter who would command the kind of international prices that suited his kind of creations and 2) Kapoor has been the most consistent on the scene for close to two decades and he had been the one to best capitalize on the market. However, his familiarity may have taken away the exoticism which he thrived on initially.

However, the same art-market insiders predict that the Indian art market value will cross that of the Chinese market in the next three to four years. In 2009, the average price of individual works of high-end Chinese contemporary art was in the range of $19 million, whereas top-of-the-chain Indian artists commanded around $5.5 million. Thus there is always an upside to be achieved still, with a burgeoning Indian domestic as well as NRI market the counterpart of which has given the Chinese their due.

The Indian art market has been showing the most evident signs of development. Subsequently, Indian artists have reasons to cheer up.

Image Courtesy : Sotheby's, Christie's and the Artists

*2010 values are as of October 29, 2010

*As per print media, internet, auction reports & artnet