- Prelude

- Editorial

- Raghu Rai: The Historian

- Ryan Lobo, 34 in Baghdad

- Through the Eye of a Lensman

- Adrian Fisk

- And Quiet Flows the River

- The Lady in the Rough Crowd: Archiving India with Homai Vyarawalla

- Raja Deen Dayal:: Glimpses into his Life and Work

- Raja Deen Dayal (1844-1905) Background

- Vintage Views of India by Bourne & Shepherd

- The Outsiders

- Kenduli Baul Mela, 2008

- Collecting Photography in an International Context

- Critical Perspectives on Photograph(y)

- The Alkazi Collection of Photography: Archiving and Exhibiting Visual Histories

- Looking Back at Tasveer's Fifth Season

- Kodachrome: A Photography Icon

- Three Dreams or Three Nations? 150 Years of Photography in India, Pakistan and Bangladesh

- Show And Tell – Exploring Contemporary Photographic Practice through PIX

- Vintage Cameras

- Photo Synthesis

- The Right Way to Invest

- What Happened and What's Forthcoming

- Art Events Kolkata: March – April 2011

- Art Bengaluru

- Mumbai Art Sighting

- North East Opsis

- Previews

- In the News

- Somnath Hore

ART news & views

The Right Way to Invest

Volume: 3 Issue No: 16 Month: 5 Year: 2011

Market Insight

by AAMRA

What is more pragmatic for the health of the art market?

The Economic Times, in a report dated March 20, 2011, expressed the wisdom that for the Indian art market to flourish, more and more corporate patronisation is needed, beside the support of galleries, museums and fairs.

“Many corporate organisations and institutions have been extending support to the arts in the last several years in the form of sponsorships of events and artists, by commissioning artworks and through other means. Such activities had significantly reduced during the phase when most companies were facing financially-difficult situations and were forced to curtail expenditures,” it says.

At the same time, the report throws light on the changing face of the present situation. “However, now that the economic conditions have improved, there could be more support to the arts. As there are multiple forms of visual arts ranging from contemporary art to folk arts, and everything else in between, it offers a lot of choice to promoters.

'What is also interesting is that the involvement of corporates and other promoters in whatever capacity they deem appropriate can turn out to be a mutually beneficial process. The artist gets the much-needed support, generally in the form of financial remuneration.

'The promoter gains through the association and by acquiring a certain number of artworks, not to forget the possibility of financial returns on these artworks over a period of time. It ca n even be termed as a means to making a long-term financial investment with add-ons that benefit corporate image.”

However, this very mindset that of a 'means to making a long-term financial investment' is what was questioned by a recent artnet.com blogpost which argued that promoters, despite the way the speculation market backfired two years back, have again returned to the fold, albeit stealthily, and have again strategically started changing the focus from art towards money.

The well-written piece raised a very valid question what is more important, the value of art or the value of money, which brings us back to the age-old question that lies at the heart of the art market. Is art to be treated as an investment like land or real estate or gold or stocks, which can be bought at a convenient time when the prices are suffering a bear-fever by market standards and then sold off at another time when the bull-run begins?

The art market actually hinges on a very fine balance. A slight tilt this way or that, and genuine art can be replaced by speculative art in the hands of manipulators, of whom there are many. Even institutionalised manipulation cannot be discounted at times, especially in larger markets in developed countries. That this speculative nature was responsible for the worldwide slump has been written about and proved beyond doubt.

In support of this, Forbes India had recently come out with another well researched piece on the market for Indian artists. Titled 'Art Market is Back', it admonishes, “During the art market boom, people looked at art as a commodity and put their money in without assessing quality or price points. Flush with profits from stock markets or real estate, they put money in art purely for a signature and set themselves up for failure.

'Then the international markets tanked, and those who partook in such deals panicked, tried to sell the works and realised their loss. From September 2008 (when Lehman Brothers collapsed) to March 2009, the total auction value in the modern and contemporary sectors dropped by 63 percent and 93 percent respectively, according to research firm ArtTactic.”

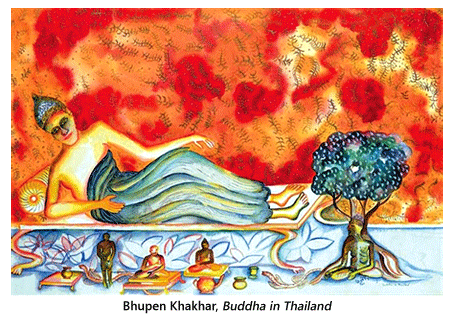

It's not for nothing that a prestigious economic magazine like Forbes takes note of a trend. And in declaring that the 'Art Market is Back', Shaista Bharwani, the author means the market of Indian artists. As an example, the performance of Bhupen Khakkar is quoted. “In 2002, Bhupen Khakhar's Buddha in Thailand sold for $8,963 at Christie's. The same painting was bought in 2010 for $52,500, having appreciated 486 percent in less than eight years. Never mind that the world went through a recession that saw the art market virtually collapse.

'Yes, the good news is that art investment is back in business. The past year has seen a smart recovery in values and the top artists are quoting at the pre-crisis prices again. If you missed the action in 2010, don't fret. There is a lot of room left for making money in art if you choose well…”

The change in perception is outlined by Menaka Kumari-Shah of Christie's Mumbai. She is quoted in the report as saying, “If you buy something you love, chances are that down the road if you want to sell it, there will be others who will also like it and want to buy it,” adding, “mind you, art doesn't come with P/E multiples or other measurements of value. It is all about the personal connection which cannot be put in a spreadsheet.”

Actually, Modern art has recovered faster due to its unarguable historical value and decreasing quantity. The modern art market, which includes artists born before 1947, is almost back on track.

Data from ArtTactic shows that the average auction prices which had halved between June 2008 ($112,000) and March 2009 ($54,000), bounced back by September 2010 ($92,000). This still lags behind the 2008 peak and that's where the opportunity lies. “Progressives and the Modern masters' works, which are considered blue chip, are commanding very high prices and significant works are selling for world record prices at almost every auction,” a report quotes Anuradha Ghosh Mazumdar, specialist in Indian art at Sotheby's.

However, there is still a lot to achieve. The contemporary sector which includes artists born post-independence had suffered much more and will take longer to recover, think market researchers. They advise to regard them, contemporary artists that is, as mid-cap or small-cap stocks. Anders Petterson, founder and managing director, ArtTactic opined in a report, “Before the crisis, they had seen a boom that was cut short,” In June 2008, the average auction price was $89,000. These prices were unsustainable and the false notions “needed to be brought down to earth,” Sanjay Kumar, director, Sakshi Art Gallery said in a report. Small wonder that they crashed by 84 percent to $14,000 in March 2009.

As a result, buyers have now become more selective about the works they buy. The average auction price moved up to $63,000 in September 2010, but many contemporary artists are still languishing at the bottom. This slow revival has made lots of valuable works available at relatively affordable prices.

This is where the problem lies. Speculators will not let an opportunity like this go by easily. And in a situation like this, there is every possibility of what is crudely called the 'hoarding' phenomenon. To put it easily, contemporary artists will be bought at a lower rate since they are cheaply available in the market, that too in large quantities. And there will eventually come a time, when those who have 'hoarded' will work the secondary market and raise the price of such works by controlling their availability. The rarer a piece or a signature, the greater its valuethis simple truth of economicswill be taken resort to.

This can only be controlled if genuine investors take control. In Forbes' opinion, “It is now the best time to buy any art, especially works by the moderns as the supply of good works is not going to remain forever, especially with so many museums coming up. If you buy now, you could reap the benefits in a year or two when the market peaks.”

So how do you build a sound portfolio?

Forbes advises, “It is advisable to have a portfolio with both modern and contemporary works as each has its strength and potential. The former illustrates our nation's history and will continue to appreciate due to this significance, while the latter represents the culture of our times.

'However, “an art portfolio should consist mostly of moderns. Their works have surpassed the market movements and sustained. Invest a smaller percentage on contemporaries because a lot of them have shown erratic movements in terms of pricing and many have not been able to sustain their quality. Focus on those whose prices have not been unnaturally volatile,” says Sunaina Anand, director, Art Alive Gallery.”

That is where and how the art-investors with a genuine love would be able to step in and at the same time protects the art market from speculators. Corporates genuinely interested in art and investing in it should also take notice. They should not buy at any cost. Rather, they should buy wearilybeing genuinely concerned about how and on whom they are investing. And in this field, gallerists and collectors can play a very important part in the corporates' choice of art investments.