- Publisher's Note

- Editorial

- The Enigma That was Souza

- Progressive Art Group Show: The Moderns

- The Souza Magic

- M.F. Husain: Other Identities

- From All, One; And From One, All

- Tyeb Mehta

- Akbar Padamsee: The Shastra of Art

- Sensuous Preoccupations of V.S. Gaitonde

- Manishi Dey: The Elusive Bohemian

- Krishen Khanna: The Fauvist Progressive

- Ram Kumar: Artistic Intensity of an Ascetic

- The Unspoken Histories and Fragment: Bal Chhabda

- P. A. G. and the Role of the Critics

- Group 1890: An Antidote for the Progressives?

- The Subversive Modernist: K.K.Hebbar

- Challenging Conventional Perceptions of African Art

- 40 Striking Indian Sculptures at Peabody Essex Museum

- Tibetan Narrative Paintings at Rubin Museum

- Two New Galleries for the Art of Asia opens at the Museum of Fine Arts in Boston

- Raphael, Botticelli and Titian at the National Gallery of Australia

- The Economics of Patronization

- And Then There Was Zhang and Qi

- What Happened and What's Forthcoming

- Random Strokes

- Yinka Shonibare: Lavishly Clothing the Somber History

- A Majestic “Africa”: El Anatsui's Wall Hangings

- The Idea of Art, Participation and Change in Pistoletto’s Work

- On Wings of Sculpted Fantasies

- The Odysseus Journey into Time in the Form of Art

- On Confirming the Aesthetic of Spectacle: Vidya Kamat at the Guild Mumbai

- Dhiraj Choudhury: Artist in Platinum Mode

- Emerging from the Womb of Consciousness

- Gary Hume - The Indifferent Owl at the White Cube, London

- Daum Nancy: A Brief History

- Experimenting with New Spatial Concepts – The Serpentine Gallery Pavilion Project

- A Rare Joie De Vivre!

- Art Events Kolkata-December 2011– January 2012

- Art Bengaluru

- Mumbai Art Sighting

- Delhi Dias

- Musings from Chennai

- Preview, February, 2012- March, 2012

- In the News-January 2012

ART news & views

And Then There Was Zhang and Qi

Issue No: 25 Month: 2 Year: 2012

Market Insight

by AAMRA

For quite some months now, artetc. news & views, in keeping with the most evident international art auction trends, has been focusing on the Chinese market and its extraordinary growth. This growth has had its supporters and detractors in equal measure. While Western Auction Houses have flocked to Hong Kong to reap the results of this new-found market, art market observers from the West itself have been skeptical of the growth patterns of the Chinese art market, with some describing it as nothing more than a bubble.

Be that as it may, art market research and analysis Art Tactic and the financial wire news service Bloomberg had, by the end of 2011 placed China ahead of the West in the art market scene, with relatively unknown Chinese contemporaries grossing over the traditional western blue-chip masters.

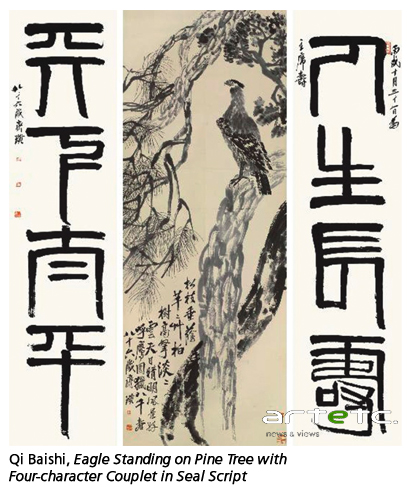

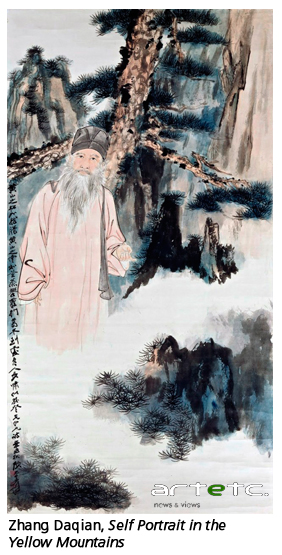

And the very first month of 2012 resoundingly established the fact, with Chinese artists Zhang Daqian and Qi Baishi edging out Pablo Picasso and Andy Warhol from the first and second edition as the world's highest grossing artists. Art Info reported on January 12, 2012, “Pablo Picasso has held onto the number one spot on Artprice's annual ranking of artists sorted by their auction prices for 13 out of the past 14 years. But the 2011 numbers have been crunched and the great man has been unseated. He didn't lose to last year's Western auction room darling Andy Warhol, but to two of the best modern Chinese artists most westerners have never heard of.”

And the very first month of 2012 resoundingly established the fact, with Chinese artists Zhang Daqian and Qi Baishi edging out Pablo Picasso and Andy Warhol from the first and second edition as the world's highest grossing artists. Art Info reported on January 12, 2012, “Pablo Picasso has held onto the number one spot on Artprice's annual ranking of artists sorted by their auction prices for 13 out of the past 14 years. But the 2011 numbers have been crunched and the great man has been unseated. He didn't lose to last year's Western auction room darling Andy Warhol, but to two of the best modern Chinese artists most westerners have never heard of.”

Zhang Daqian (1899-1983) came in at number one while Qi Baishi (1864-1957) claimed second place in Artprice's survey. Warhol was third, while Picasso was shunted to the fourth position. Zhang's top spot was won on the back of the artist's grand total of $506.7 million in 2011 auction sales. Qi Baishi's work earned $445.1 million, while Picasso could clock just $311.6 million.

But what had exactly happened that in a matter of a year, such established names like Picasso and Warhol were out-throned?

Experts put it on the sluggish performance of the duopoly of Sotheby's and Christies in the West and the huge rush that every auction house is making to have their own piece of pie of what is being touted as art-market's El Dorado of the new decadeSouth-East Asia. However, the problem with buyers here is that the demography is far from traditional, as also their taste. When a collector buys a piece of art, it is mainly out of one single emotionbecause s/he loves the piece in question. The South-East Asian collectors come with a very different mindset. They are more steeped in tradition than be fascinated by the novelty of experiments. Picasso's Cubism or Warhol's post-modern icons may titillate them, but they are more comfortable with a modern rendition of a mythical scene or a traditional rendition of a modern inspiration, when it comes to possession and display of a piece of art in their personal space. Thus an Indian collector will be more at ease with the rendition of Raza's geometrical shapes, reminiscent of the Rangolis of his Indian origin than the radical art of a Damien Hirst. Similarly a Chinese or any other South-east Asian collector will identify with the style and content of a Zhang Daqian who has been described by Art Info as “famously prolific and almost preternaturally talented, able to imitate any style and period of Chinese painting.”

Experts put it on the sluggish performance of the duopoly of Sotheby's and Christies in the West and the huge rush that every auction house is making to have their own piece of pie of what is being touted as art-market's El Dorado of the new decadeSouth-East Asia. However, the problem with buyers here is that the demography is far from traditional, as also their taste. When a collector buys a piece of art, it is mainly out of one single emotionbecause s/he loves the piece in question. The South-East Asian collectors come with a very different mindset. They are more steeped in tradition than be fascinated by the novelty of experiments. Picasso's Cubism or Warhol's post-modern icons may titillate them, but they are more comfortable with a modern rendition of a mythical scene or a traditional rendition of a modern inspiration, when it comes to possession and display of a piece of art in their personal space. Thus an Indian collector will be more at ease with the rendition of Raza's geometrical shapes, reminiscent of the Rangolis of his Indian origin than the radical art of a Damien Hirst. Similarly a Chinese or any other South-east Asian collector will identify with the style and content of a Zhang Daqian who has been described by Art Info as “famously prolific and almost preternaturally talented, able to imitate any style and period of Chinese painting.”

These were the two main reasons behind the story of Daqian and Baishi outperforming Picasso and Warhol is gross auction turnovers. As the Financial Time's Editor-at-large of the Art Newspaper, Georgiana Adam noted in her 2011 round-up of the world art market trends, “In 2011 China finally emerged as the world's number one market…. mainland Chinese auction houses have demonstrated extraordinary firepower in the past year, while the Hong Kong sales (where foreign auction houses sell, as they are largely debarred from the mainland) were also remarkably punchy for most of the year. Sotheby's and Christie's racked up more than $1.8bn in Hong Kong, to which must be added sales there by smaller firms from Korea, Taiwan, Malaysia and Japan.”

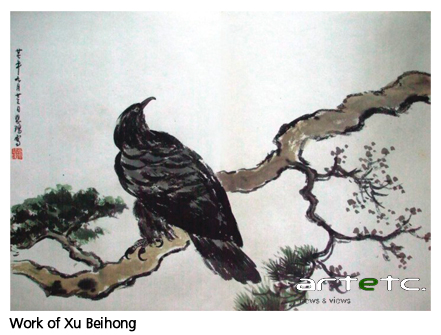

As Art Info writes, “Zhang and Qi's 2011 win has been three years in the making. From the moment the global auction market's center of gravity shifted east in the wake of 2008's global financial crisis, the stocks of China's modern masters have been rising. These artists Qi, Zhang, Fu Baoshi, Xu Beihong, and Wang Guangzhong included were painters active in the modern period who continued to utilize the techniques of traditional Chinese painting, but innovated in their concept and execution.”

As Art Info writes, “Zhang and Qi's 2011 win has been three years in the making. From the moment the global auction market's center of gravity shifted east in the wake of 2008's global financial crisis, the stocks of China's modern masters have been rising. These artists Qi, Zhang, Fu Baoshi, Xu Beihong, and Wang Guangzhong included were painters active in the modern period who continued to utilize the techniques of traditional Chinese painting, but innovated in their concept and execution.”

However, as we had pointed out earlier, there are detractors too to this South-east Asian and especially Chinese growth story. Adam, for example, in the same round-up quoted above puts in a very significant phrase in the same breath as she discusses the Chinese dominance, “there is doubt about the total reliability of their figures,” and goes on to elucidate her point in a more focused way, “…the first half of the Meiyintang sale of Chinese ceramics this spring missed its $91m-$137m target and totalled just $51.2m with 23 lots bought in. The Works of Art sale at Christie's Hong Kong in November was “a bloodbath” in the words of one person in attendance (it made $66m, with only 57 per cent of the lots sold)…”

There are others who are also ringing the alarm bell. After the Qi and Zhang phenomenon was widely reported in the media, Felix Salmon, Reuters' commentator on the art market wrote in his blog, “And the sheer levels here! Picasso has never grossed more than $363.7 million in one year; both Zhang and Qi handily beat that figure in 2011, without anything approaching Picasso's place in the canon. And the way that these artists came out of nowhere makes (the) growth seem positively sluggish.”

Though not so bile, Lorenzo Rudolf, mastermind behind Art Age Singapore in a recent interview to Art Info had made a very significant point. “China is the biggest potential market for the future. But we have to be clear: It is not as far along as some people think it is. So many Western galleries run to Asia like they're heading to El Dorado. I think we are not yet there. You have more collectors in Taiwan and Indonesia than in mainland China. The supply of Western art that will be coming to Hong Kong in the next few months will be much greater than the demand at the moment... I was impressed by the quality of the galleries, but there was not yet the market for all this Western art. Galleries like Gagosian and White Cube are big enough and clever enough to succeed, but I think many galleries that are expanding to Asia are going to come back with bloody noses.”

His statement does not only comment on what he thinks to be the nature of the Chinese market, but also illustrates a point we made earlier in this article, while dwelling on the preference of the South-East Asian collectorsthat western art may not necessarily have ready takers in this market. And in the midst of all these speculations, Nicholas Forrest, the art market analyst and commentator on art market trends from Australia has recently made a very important point on his blog the artmarketblog.com“ – Artprice have announced that Singapore should soon overtake France in the field of Contemporary art sales… What first alerted me to the importance of Singapore to the market for Southeast Asian art was the number of works by Indonesian and Filipino artists being sold by Singaporean auction houses. The main auction houses with a presence in Singapore are Masterpiece Fine Art Auction, Borobudur Auction, Larasati Auctioneers and 33 auction. Enticing bidders with the lowest buyer's premium in Singapore of between 10% - 12%, 33 auctions have proven to be one of the main players in the Singapore art market. Having moved major sales of modern and contemporary South-East Asian paintings from Singapore to Hong Kong in 2007, both Christie's and Sotheby's may now be regretting this move. The move did, however, allow the regional auction houses to gain a foothold that has resulted in a strong regional art auction market that continues to grow.

'Without the same high profile as artists coming out of Indonesia and the Philippines, Singaporean contemporary artists still have a long way to go before they catch up to the success of Singapore as a destination for Southeast Asian art. But, with the way the Singapore art market is heading, it may only be a matter of time before we see some big prices for Singaporean artists and the French being left behind by the Singapore art market machine.”

Forrest however, does not compare the potential of the Singapore market with that of the Chinese market. But according to what Reuters' Salmon writes in his blog, “Thanks to commentator TW Andrews/Alex Tabarrok/Daniel Lippman… There are rigged auction houses all over China and they become the most suitable places for elegant corruption…” and then Salmon goes on to detail how this corruption takes place. Though not in so scathing terms, it was a point made more or less, by Forrest way back in 2011.

So is the Zhang and Qi story here to stay? We may have to wait for the year-end to get the answer.